new short term capital gains tax proposal

Long term if you held asset for more than one year. 7 rows Federal short-term capital gainsincome tax rate Single Married filing jointly Married.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Best short-term investments.

. The short-term capital gains tax is typically applied to the sale of securities including stocks and mutual funds. Subscribe to receive email or SMStext notifications about the Capital Gains tax. Capital assets include stocks bonds and real estate.

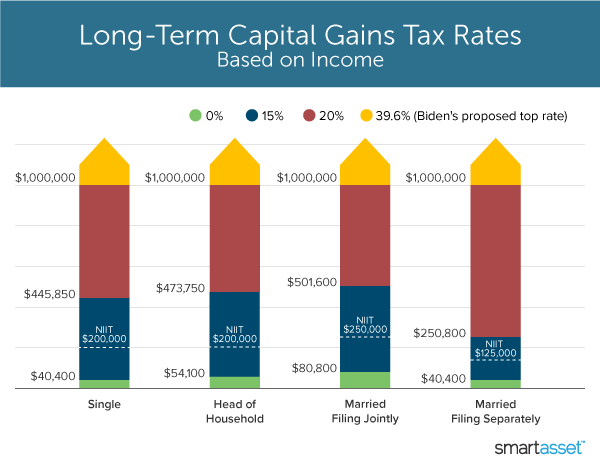

5 rows The proposal by House Democrats will also apply a surtax of 3 percent for people with modified. Short Term and Long Term with Short Term being taxed much higher and Long Term taxed within your applicable tax bracket. Sole proprietor income retirement accounts homes farms and forestry are exempt.

The new tax would affect an estimated 58000 taxpayers in the first year. The impacted assets include stocks bonds real estate and art. This proposed change says all gains long and short will be taxed at the higer rate for anyone who makes over 1Million income.

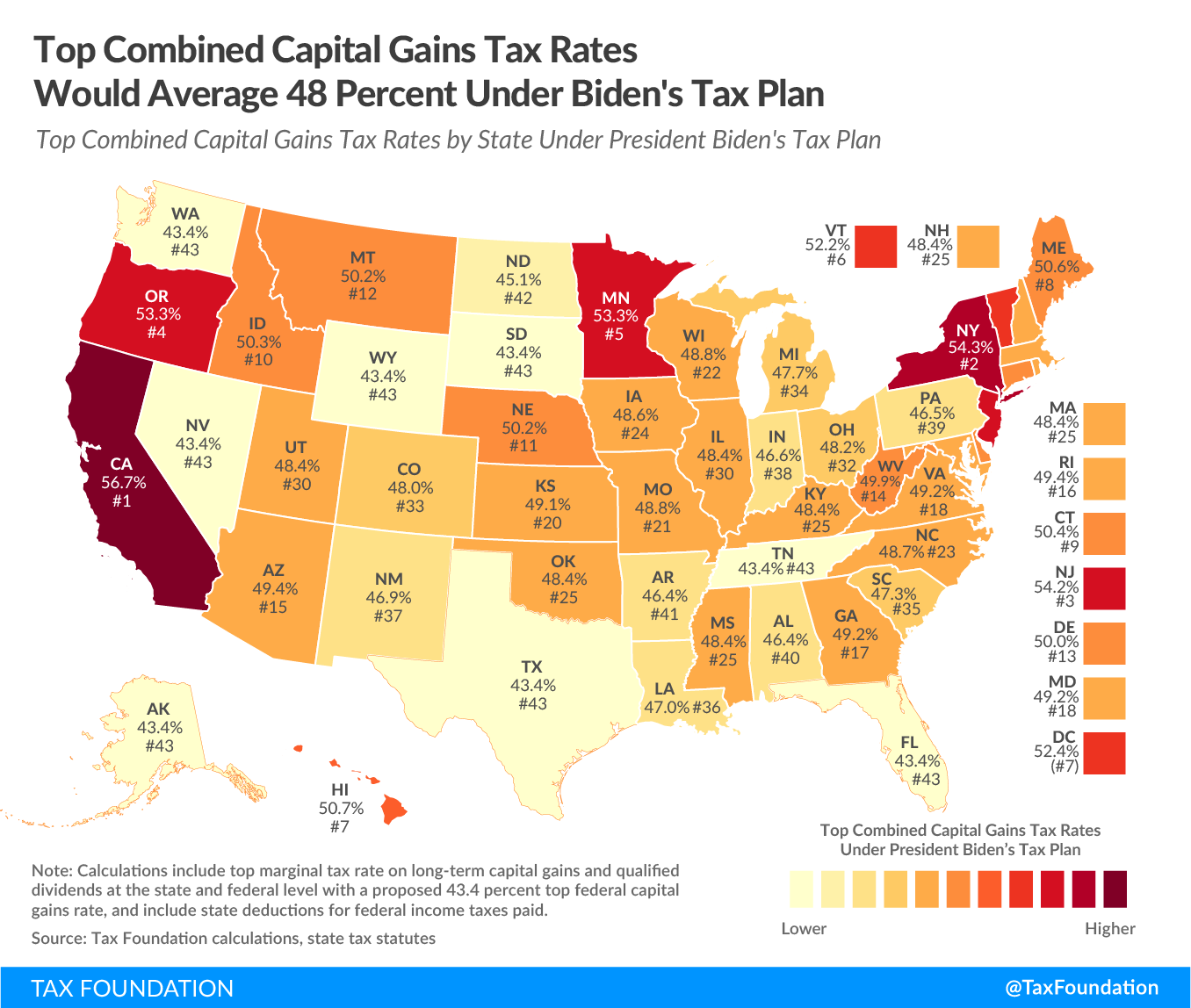

For taxpayers with income above 1 million the long-term capital gains rate would increase to. When you sell a capital asset for more than you paid for it you realize a capital gain. Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the District of Columbia and reach 582 percent in New York City12 The combined average federal and state capital gains would surpass Denmark Chile and France to become.

President Joe Biden is expected to propose raising the top federal capital gains tax to 396 from the current 20 for millionaires. Not all capital gains are treated equally. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

The impacted assets include stocks bonds real estate and art. Reform Capital Gains Tax. A Guide to the Capital Gains Tax Rate.

The proposal by House Democrats would also apply a surtax of 3 percent on persons with adjusted. 15 Mar 2022 0558 AM IST Gireesh Chandra. Currently taxes on gains fall into 2 classifications.

Short-term capital gains on listed equities held for under a year is taxed at 15. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. The proposal would tax long-term capital gains as ordinary income for taxpayers with taxable income above 1 million and raise the top marginal income tax rate to 396 percent.

When combined with the 38 percent net investment income tax NIIT and average top state capital gains tax rates the proposal would lead to a top combined rate of 484. Retirement accounts homes farms and forestry are exempt. Short term if one year or less.

The tax rate can vary and knowing the difference. The institution says raising capital gains tax rates to the proposed level would be the highest since the 1920s potentially shaving off 01 percent from economic growth and reducing federal. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. House democrats on monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed. Govt plans reform in capital gains tax.

The tax youll pay on the capital gain depends on how long you held the asset before selling it. 3 min read. The proposed higher tax on capital gains would be consistent with President Bidens promise to limit tax increases to.

Short-term capital gains tax is a tax on gains resulting from the sale of assets youve held for one year or less. But its also possible to be assessed short-term capital gains tax on the sale of other assets such as real estate vehicles or collectibles. Capital gains are currently taxed at a.

The new tax would affect an estimated 42000 taxpayers about 15 percent of households in the first year. More from Your Money Your Future. History Of The Top Long-Term Capital Gains Tax Rate.

The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Long-term Capital Gains Taxes Tax Tip of the Day. The top short-term capital gains tax rate is 37.

Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is. The top long-term capital gains rate has been 20 since 2013 according to. New short term capital gains tax proposal.

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The Capital Gains Tax And Inflation Econofact

How Do State And Local Individual Income Taxes Work Tax Policy Center

How High Are Capital Gains Taxes In Your State Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Budget 2022 Will Capital Gains Tax Be Rationalized Across Asset Classes

Long Term Capital Gains Vs Short Term 2022 Taxes White Coat Investor

What S In Biden S Capital Gains Tax Plan Smartasset

Long Term Capital Gains Vs Short Term 2022 Taxes White Coat Investor

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)